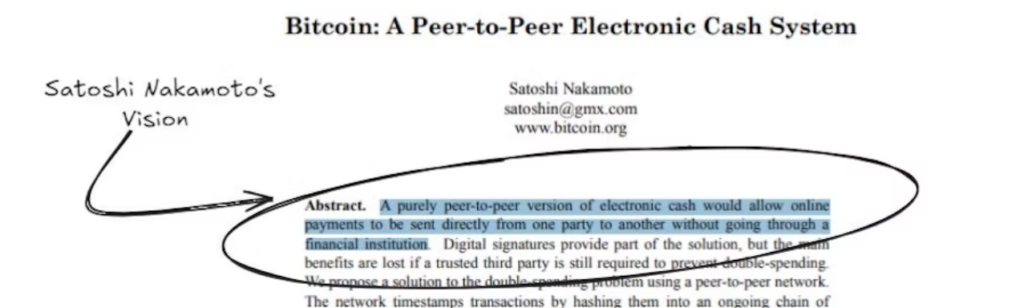

When Bitcoin was first introduced by the mysterious figure Satoshi Nakamoto in 2008, it came with a grand vision: a decentralized, peer-to-peer digital currency that would bypass traditional financial institutions and empower individuals to take control of their wealth. The promise was simple yet revolutionary—a new financial system based on transparency, freedom from central control, and security. But as we move deeper into 2024, some are beginning to question whether Bitcoin has strayed from that original path. Has Bitcoin lost its guiding road, or is it simply evolving?

The Original Vision: Decentralization and Autonomy

At its core, Bitcoin was built on the principles of decentralization. By operating on a distributed ledger, known as the blockchain, Bitcoin allowed for transactions to take place without the need for intermediaries like banks or payment processors. The blockchain was maintained by a global network of miners who validated transactions and secured the system in exchange for newly minted Bitcoin.

This structure was meant to provide financial autonomy to users, especially in regions where access to banking was limited or government-controlled currencies were unstable. Bitcoin represented freedom from centralized control, providing individuals with the ability to store and transfer value outside of traditional financial systems. It also promised transparency and security, as every transaction was recorded on a public ledger that was nearly impossible to tamper with.

Bitcoin’s Road to Mainstream Adoption

As Bitcoin gained popularity, its journey to mainstream acceptance came with both successes and challenges. Institutional investment began to pour in, legitimizing Bitcoin as a financial asset. Large companies such as Tesla and Square announced significant investments, and Bitcoin began to be accepted as a payment option by major retailers. Governments and regulators also took note, with some embracing the cryptocurrency and others attempting to regulate or restrict its use.

However, this increasing institutional interest brought unintended consequences. Bitcoin, once a tool for individual financial empowerment, was now seen primarily as an investment asset, more akin to digital gold than an everyday currency. Volatility, long a concern in the cryptocurrency space, became an even bigger issue as speculators flooded in, pushing Bitcoin’s price to all-time highs and lows in rapid succession. This focus on price speculation led to a shift in Bitcoin’s narrative—from a revolutionary currency to a store of value or hedge against inflation.

Has Bitcoin Lost Its Way?

There are several indicators that Bitcoin may be diverging from its original purpose:

1. Institutional Control vs. Decentralization

Bitcoin’s decentralized nature was one of its most compelling features. However, as large institutions and wealthy individuals accumulate vast amounts of Bitcoin, the network’s decentralized ethos comes under strain. Today, a significant portion of Bitcoin’s supply is concentrated in the hands of a relatively small number of holders, sometimes called “whales.” This concentration of wealth contrasts sharply with the idea of democratizing finance.

Additionally, the rise of Bitcoin-based financial products such as futures contracts, ETFs, and custody services means that traditional financial institutions are increasingly acting as gatekeepers. While this provides easier access for mainstream investors, it also reintroduces intermediaries into the Bitcoin ecosystem, undermining the initial vision of a peer-to-peer financial system.

2. Environmental Impact

Bitcoin’s reliance on proof-of-work (PoW) mining has drawn heavy criticism due to its environmental impact. Mining Bitcoin requires vast amounts of energy, often produced by non-renewable sources. This has led to public backlash and has raised questions about the long-term sustainability of Bitcoin mining.

Many in the cryptocurrency space, including developers of competing projects, argue that Bitcoin’s commitment to PoW is outdated. While there have been proposals to adopt more energy-efficient models like proof-of-stake (PoS), Bitcoin’s core community remains resistant to change, prioritizing security and decentralization over environmental concerns.

3. Transaction Speed and Fees

Bitcoin’s limitations as a medium of exchange have become increasingly apparent as adoption has grown. Transaction times can be slow, and fees can become exorbitant during periods of network congestion. While Layer 2 solutions like the Lightning Network aim to address these issues by enabling faster and cheaper transactions, widespread adoption of these technologies has been slow.

For many, Bitcoin’s usability as a daily currency is diminishing. It is often more practical to use alternative cryptocurrencies, stablecoins, or even traditional financial systems for everyday transactions.

4. Regulatory Pressures

As governments around the world grapple with how to regulate Bitcoin, there are growing concerns about the future of its use in a world where compliance with local laws might contradict Bitcoin’s decentralized ethos. Countries like China have banned Bitcoin mining, and others have introduced Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements that undermine the pseudonymous nature of Bitcoin transactions.

Some Bitcoin advocates fear that these regulations could strip away the very freedoms that Bitcoin was designed to protect, turning it into just another regulated financial asset rather than a tool for financial sovereignty.

Evolving, Not Losing Its Way?

While these criticisms suggest that Bitcoin may be drifting from its original vision, others argue that Bitcoin is simply evolving. Every technology goes through growing pains, and as Bitcoin has matured, it has adapted to meet the needs of a broader audience.

1. Store of Value

For many, Bitcoin’s role as digital gold is a natural progression. In a world of inflationary fiat currencies and uncertain economic conditions, Bitcoin provides a secure store of value outside of government control. While this wasn’t Nakamoto’s primary goal, it may be a necessary evolution to ensure Bitcoin’s longevity.

2. Financial Inclusion

Despite its shortcomings as a currency, Bitcoin continues to be a powerful tool for financial inclusion. In regions with weak currencies, restrictive banking systems, or unstable governments, Bitcoin provides a lifeline to individuals seeking to store and transfer value without relying on traditional institutions. The adoption of Bitcoin as legal tender in El Salvador, for example, highlights its potential to empower the unbanked.

3. Lightning Network and Layer 2 Solutions

Technological solutions like the Lightning Network aim to address Bitcoin’s scalability issues. While still in development, these technologies could bring Bitcoin back in line with its original vision as a usable currency for daily transactions. As these systems improve, Bitcoin may once again become a practical option for peer-to-peer payments.

A Fork in the Road?

Has Bitcoin lost its guiding road, or is it simply adapting to the realities of a changing world? The answer likely depends on who you ask. For some, Bitcoin’s shift towards being a store of value and investment asset represents a betrayal of its original ideals. For others, this evolution is a natural step in the cryptocurrency’s journey, enabling it to achieve long-term stability and mainstream adoption.

In the end, Bitcoin’s future may rest on a delicate balance between staying true to its founding principles of decentralization and autonomy, while also adapting to the needs of a global financial ecosystem. Whether it can strike that balance remains to be seen, but one thing is certain: Bitcoin’s road, while no longer clearly defined, is far from over.